Housing inventory shortages drive seller's market in November, Redfin reports

Redfin's housing market predictions for 2022 are more positive with a higher supply of new homes causing price growth to slow down. But by then, higher mortgage rates are likely to impact housing affordability. (iStock)

If a new house is at the top of your holiday wish list, it may take a Christmas miracle to find your dream home in today's housing market. Home supply fell 18% year-over-year in November, driving high demand and pushing housing prices up 15%, according to Redfin.

"I wish I had better news for homebuyers this holiday season, but in many ways the housing market is more challenging than ever," said Redfin Chief Economist Daryl Fairweather.

Today's homebuyers are facing a number of unprecedented challenges, with record-low housing supply driving up median sales prices across the country. But there is a silver lining: Redfin forecasts more listings and slower home-price growth in 2022, which may make it easier to buy a home in the new year.

However, the time to lock in a record-low mortgage rate is running out. Mortgage rates are expected to rise next year as the Federal Reserve plans up to three rate hikes. If you're considering buying a home soon or refinancing your current mortgage, act fast to secure a low mortgage rate.

You can visit Credible to browse mortgage rates across multiple lenders at once to ensure you'll find the lowest possible rate for your financial situation.

HERE'S HOW THE COVID-19 PANDEMIC CHANGED THE MORTGAGE PROCESS

Housing supply challenges impact the country's hottest markets

Across the U.S., houses are selling faster and for more money than before. But select areas have even hotter housing markets, driving higher buyer demand for home sales.

Homes are pending sale within six days of hitting the market in Indianapolis and Seattle. In Denver and Grand Rapids, Mich., homes spend a median of seven days on the market.

Buyers in Oakland, Calif., are paying more than expected for the homes they want — more than three-quarters (76.7%) of houses sold for above listing price in the Bay Area.

Other coastal cities in California and New York are facing the same challenge: the vast majority of homes in San Jose, Calif. (75.8%), San Francisco (64.7%), Rochester, N.Y. (64.7%) and Buffalo, N.Y. (64.4%) are selling for more than they were listed for thanks to cutthroat bidding wars.

Home prices are surging in several markets in Southern states like Florida and Texas, but that's consistent with the rest of the nation. None of the 85 metro areas Redfin monitors saw price declines in November. Here's where home prices climbed the most:

- Austin, Texas: $468,798 (+31.2%)

- Phoenix: $430,000 (+27.4%)

- North Port, Fla.: $403,000 (+27.1%)

- West Palm Beach, Fla.: $400,000 (+25.0%)

- Raleigh, N.C.: $396,000 (+24.5%)

If you're considering buying a home in one of America's hot real estate markets, it's important to come prepared with a mortgage preapproval letter to show sellers that you're a serious buyer. You can view mortgage preapproval offers on Credible in just minutes, so you can put an offer on a home while mortgage rates are still low.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON A HOME

Low mortgage rates add to the allure of buying a home now

Despite the challenges of today's housing market, time is running out to lock in a record-low mortgage rate. While buyers might benefit from higher housing supply and less competition by waiting until next year, they'll likely pay more in borrowing costs thanks to rising mortgage interest rates.

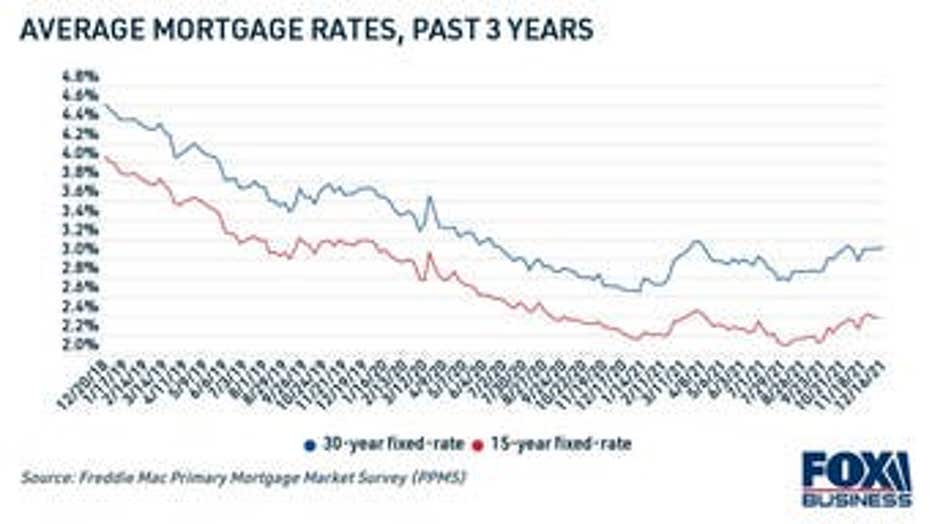

The Mortgage Bankers Association (MBA) predicts that average 30-year mortgage rates will reach 4.0% in 2022, up from 3.1% in 2021. This is due in part to the Fed's economic policy changes for next year, predicting up to three rate hikes in 2022 alone.

Mortgage rates are still relatively low, according to Freddie Mac, giving homeowners and prospective buyers the opportunity to lock in low interest rates before they inevitably rise further.

Now is the time to secure a low mortgage rate on your home purchase or refinancing loan. If you're shopping around for a mortgage or want to refinance your current home loan, be sure to compare rates across multiple lenders to ensure you're getting the best offer possible for your financial situation.

You can compare rates on Credible for free without impacting your credit score. Then, use a mortgage payment calculator to estimate the cost of homeownership.

35% OF MILLENNIALS SAY STUDENT LOAN DEBT IS PREVENTING THEM FROM BUYING A HOME

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.