Mortgage payments surged 38% annually in March, Zillow finds: Here's how to keep your housing costs low

Mortgage affordability has fallen as housing costs take up a larger portion of a homeowner's gross monthly income, a Zillow report has found. (iStock)

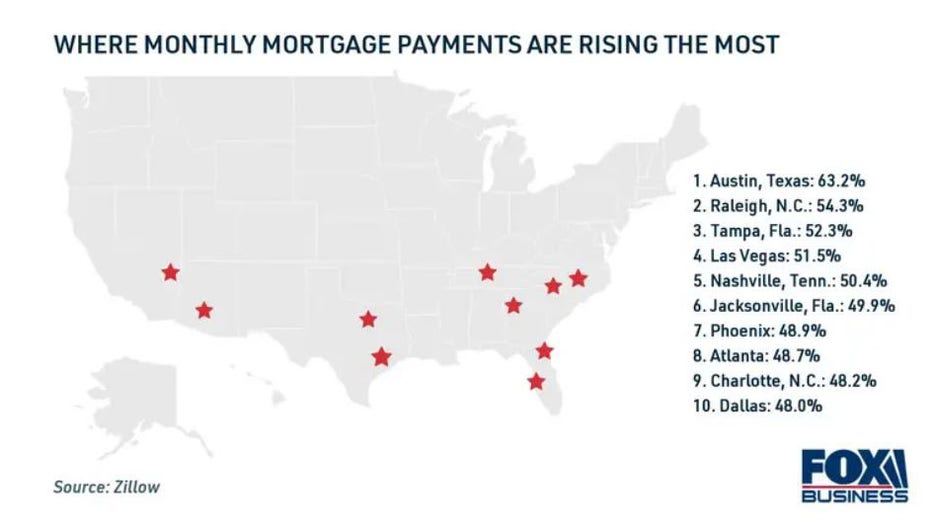

Soaring home sales prices and recent interest rate hikes have led to significantly higher mortgage costs for today's homebuyers, according to new research from Zillow. The typical monthly mortgage payment rose to $1,316 in March, which is an increase of 38% over the past year and 19.5% since December alone.

Despite dwindling housing affordability, there is "one bright spot" for home shoppers: The highly-anticipated seasonal inventory boost has finally arrived. After six consecutive months of decreasing housing stock, 11.6% more homes were available in March than in February. This is the largest single-month increase since Zillow began collecting this data.

While rising housing inventory and mortgage interest rates will eventually cool off demand in the market, prospective buyers are currently facing enough competition to sustain high home values and bidding wars — especially in select metro areas. After all, inventory is still 22.5% lower currently than it was this time last year.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON A HOME LOAN

"There will be a point when the cost of buying a home deters enough buyers to bring price growth back down to Earth, but for now, there is plenty of fuel in the tank as home shopping season kicks into gear," Zillow Senior Economist Jeff Tucker said.

Keep reading to learn about housing affordability and the 2022 housing market forecast. And if you're buying a home in today's competitive real estate market, one way to set your offer apart from the rest is to come prepared with a mortgage preapproval letter. You can begin the mortgage preapproval process on Credible.

WHAT IS PRIVATE MORTGAGE INSURANCE (PMI) AND HOW DOES IT WORK?

Rising home prices, mortgage rates diminish housing affordability

Zillow found that homebuyers are "facing a one-two punch" this spring as higher home values and mortgage interest rates drive up monthly housing expenses.

U.S. home values surged 20.6% annually in March, from $279,883 last year to $337,560 this year. That's a purchase price increase of nearly $58,000, caused by relatively low housing inventory and strong demand from potential buyers despite rising rates.

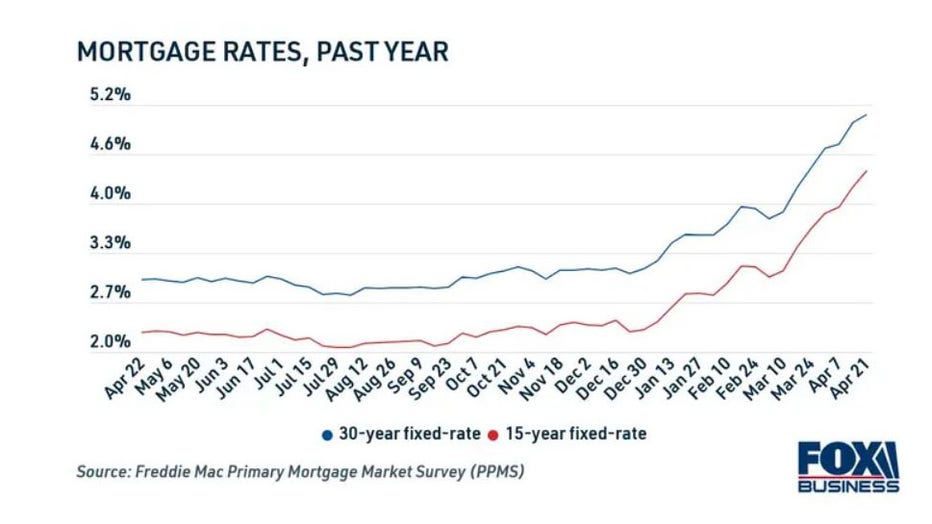

Meanwhile, average mortgage rates have skyrocketed during the first several months of 2022. This April, 30-year mortgage rates surpassed 5% for the first time since 2018 — that's compared to 3.11% at the end of 2021 and 2.97% just one year ago.

HOW TO BUY HOMEOWNERS INSURANCE

"Higher mortgage rates were anticipated this year, but the speed of their rise has been breathtaking," Tucker said

During the pandemic, record-low mortgage rates were an "affordability lifeline," Tucker said, since they kept monthly payments reasonable amid escalating home sales prices. But as interest rates are anticipated to rise when the Federal Reserve implements multiple benchmark rates in 2022, mortgage costs will continue to increase in turn.

If you're purchasing a home in the current rate environment, it's important to compare estimates across multiple mortgage lenders to find the lowest rate possible for your financial situation. Additionally, you can use Credible's mortgage payment calculator to determine how much house you can afford.

BIDEN ADMINISTRATION RAISES 2022 FHA LOAN LIMITS SIGNIFICANTLY

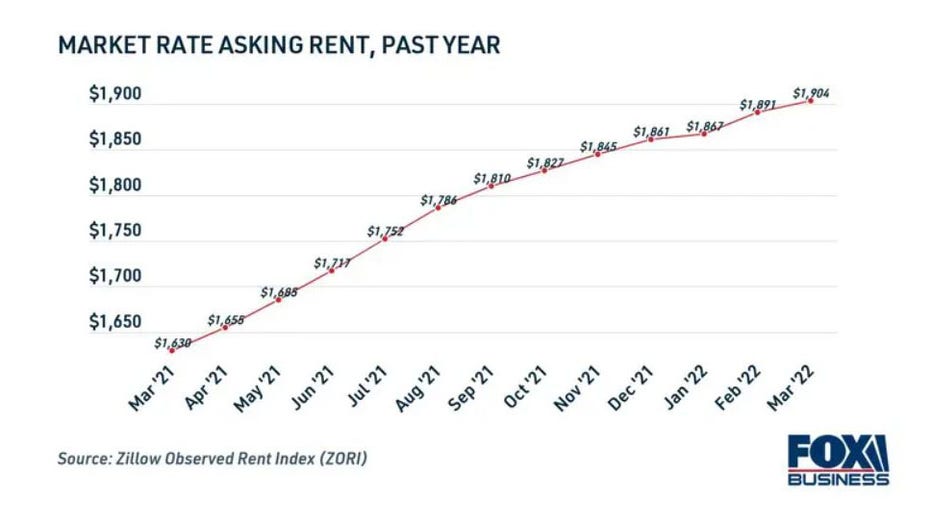

Increasing mortgage payments are outpacing rent hikes

Although Zillow data shows that monthly mortgage payments remain considerably lower than the observed market rate rent, housing costs are rising more rapidly for homebuyers than they are for renters. Rents rose 16.8% annually in March to $1,904, while mortgage payments rose 38% during the same period.

ARE MY MORTGAGE CLOSING COSTS AND FEES TAX-DEDUCTIBLE?

But despite rising mortgage payments, buying a home comes with an important financial advantage over renting. While rents tend to increase with inflation every time a tenant renews their lease, monthly mortgage payments are locked throughout the loan term. Plus, the principal of a borrower's mortgage payments go directly into their home equity — which is also on the rise as home values continue to soar.

If you're thinking about buying a home to offset rental inflation, it's important to compare rates across multiple lenders. You can browse current mortgage rates in the table below, and visit Credible to see free offers without impacting your credit score.

WHAT ARE PROPERTY TAXES? A GUIDE FOR FIRST-TIME HOMEBUYERS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.