How to apply for student loan debt forgiveness

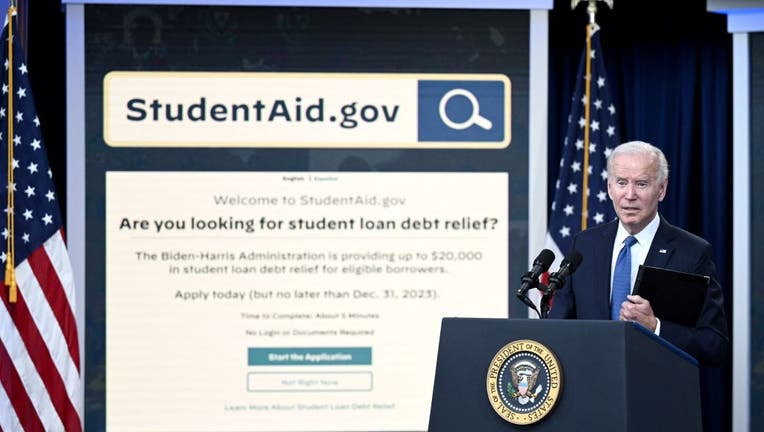

US President Joe Biden delivers remarks on the student debt relief portal beta test, in the South Court Auditorium of the Eisenhower Executive Office Building, next to the White House, in Washington, DC, on October 17, 2022. (Photo by Brendan Smialow

The application for student loan debt forgiveness is now fully available for those eligible under President Joe Biden’s new plan.

Biden announced in August that many Americans can have up to $10,000 in federal student loan debt forgiven and that those who qualified for Pell grants are eligible for $20,000 to be forgiven.

The application is now fully available at studentaid.gov after a beta version opened earlier this month.

Meanwhile, the student loan interest pause, which has been activated since March 2020 and throughout the COVID-19 pandemic, is set to expire on Dec. 31, 2022.

Wondering how to get the ball rolling on your student loan forgiveness before that interest kicks back in? Here is the information you need to know:

How to apply for student loan forgiveness

The application is available at studentaid.gov/debt-relief/application.

The application only requires giving some basic personal information to the Department of Education and shouldn’t take longer than a minute or two to fill out. It’s been touted as a "simple, straightforward" application by the Biden administration.

You’ll have to enter your name, social security number, birthdate, phone number, and email address.

And lastly, you’ll have to check a box certifying under penalty of perjury that the information about your income eligibility is correct. (More on that below.)

Once you hit submit, you’ll receive an email confirming your application was submitted.

Your eligibility will then be determined and you’ll be contacted if more information is needed. An estimated 1 million to 5 million people will be required to provide extra documentation regarding their income, the Education Department said in a recent submission to the White House's Office of Management and Budget.

If not, you’ll be notified when your application has been approved, and then your loan servicer will notify you when your relief has been processed.

Screenshot of student loan application submission acceptance.

Who should fill out a student loan forgiveness application?

More than 40 million Americans could be eligible for student loan debt forgiveness under Biden’s plan.

If you received a federal student education loan and are currently making less than $125,000 — you’re eligible and should fill out an application. (This amount increases up to $250,000 for households.)

Not everyone who is eligible for loan forgiveness under Biden’s plan will have to fill out an application.

The Education Department already has income data for about eight million people, which is about 20% of borrowers, Bharat Ramamurti, who is the deputy director of the National Economic Council, said. If those people qualify based on the income on file, they’ll get relief automatically.

It’s unclear right now how a borrower can determine if the Department of Education has that info.

Also, if you’re not certain what type of loan you have, you can check by visiting studentaid.gov. Find the "My Loan Servicers" section — and if a servicer name starts with "DEPT OF ED," the loan is held by the federal government and qualifies for one-time debt relief.

RELATED: What kind of student loan do I have? Your student loan relief questions answered

FFEL program and Perkins loans eligibility

In late September, the Biden administration quietly scaled back eligibility rules for the debt relief, eliminating a small group of borrowers who are the subject of a legal debate in an ongoing lawsuit.

The Education Department updated its website Sept. 29 saying borrowers with federal loans that are owned by private banks, including the FFEL program and Perkins loans, will now be ineligible unless they already consolidated their loans into the government's direct lending program before Thursday.

The change reversed eligibility for about 770,000 borrowers, the department said.

When will my student loans be forgiven?

White House administration official Bharat Ramamurti, who is the deputy director of the National Economic Council, has previously said loan forgiveness will take about four to six weeks after the application was completed.

Filling out the application as soon as possible should clear eligible borrowers to see their loan relief before Dec. 31, when the interest pause will end.

"Borrowers are advised to apply by roughly Nov. 15 in order to receive relief before the payment pause expires on December 31," Ramamurti said.

Applications will be accepted through Dec. 31, 2023.

Things could get complicated, depending on the outcomes of several legal challenges.

The Biden administration faces a growing number of lawsuits attempting to block the program, including one filed by six Republican-led states. A federal judge in St. Louis is currently weighing the states’ request for an injunction to halt the plan. Biden on Monday said he's confident that the suit will not upend the plan. "Our legal judgment is that it won’t," he said, "but they’re trying to stop it."

Who is eligible for a student loan refund?

When Biden announced the plan to forgive student loan debt, many borrowers who kept making payments during the pandemic while interest was put on pause wondered if they’d made the right choice. But borrowers might be able to see some of that money back in their pockets.

The Department of Education says borrowers who hold eligible federal student loans and have made voluntary payments since March 13, 2020, can get a refund.

You will get an automatic refund after you apply for forgiveness if your payments during the pandemic brought your loan balance below the maximum debt relief amount.

For example, if a borrower paid $100 a month for 10 months of the pandemic and their balance is now $8,000, they can apply for forgiveness and get $8,000 canceled, plus a refund of $1,000. That borrower does not need to apply separately for a refund.

If a borrower paid throughout the pandemic and still owes $14,000, they won’t get an automatic refund. They can, however, apply to have $10,000 of the remaining debt erased.

People who have to apply separately for a refund are those who completely paid off their loan balance during the pandemic.

Borrowers who want a specific amount refunded can apply by calling their loan service provider. Right now, refunds are only being done via phone and not through any website or email.

This story was reported from Detroit. The Associated Press contributed.